Blog

What Is Payroll Outsourcing and How to Choose a Payroll Service Provider?

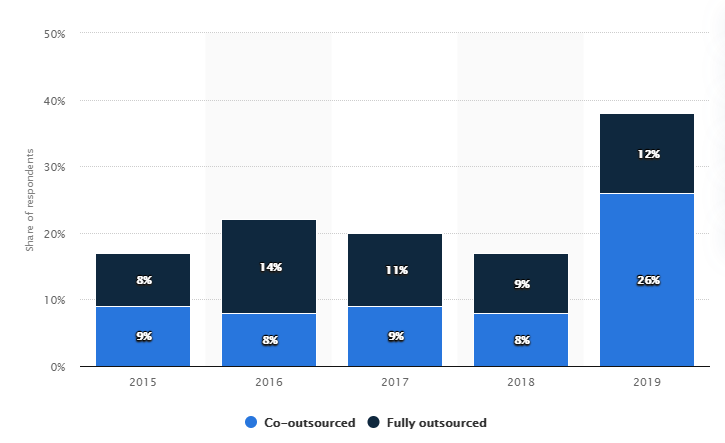

Payroll outsourcing by companies worldwide. Source: Statista

By now, you must be intrigued to know more about payroll outsourcing. To help you, we’ve put together all the essential information in this blog, so keep reading.

What is Payroll Outsourcing And Why Do Businesses Outsource Payroll Work?

Simply put, payroll outsourcing is the process of hiring an external service provider who manages payroll functions.

Managing payroll is indeed a complex job. It is a combination of skills that demands accuracy, expertise and efficiency. With frequent employment and labour law reforms, amendments, it can be challenging for business owners to comply with government regulations.

Operating with a payroll team that has insufficient knowledge about the current state of affairs can be dangerous. A small mistake in timesheet calculation can lead to inaccurate payment resulting in employee dissatisfaction. Similarly, incorrect tax calculation can result in compliance issues and attract unwanted penalties.

Training in-house staff is a time-intensive job and requires hiring specialised trainers that lead to more expenses. On the other side, without proper training, your payroll team might not function properly.

An easy and simple solution to this problem is partnering with a payroll outsourcing company. This gives you access to experienced, dedicated professionals who handle the work so that you can focus on your core business.

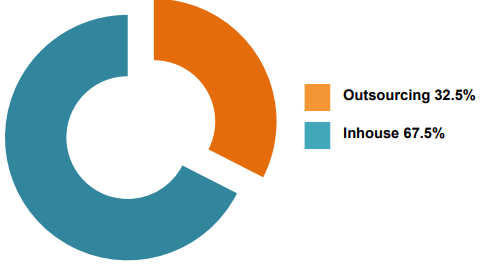

According to the Australian Payroll Association’s 2019 Payroll Benchmarking Report, 32.5% of organisations outsourced payroll work that year.

Outsourced vs inhouse payroll. Source: 2019 Payroll Benchmarking Report, Australian Payroll Association

The same report also says that in 2019, 31.5% of Australian businesses with employee strength 200 to 499 outsourced payroll.

These numbers are a testimony that payroll outsourcing is gaining momentum and more companies are choosing to work with third-party payroll companies.

How to Find the Right Payroll Outsourcing Company

With so many payroll outsourcing companies out there, it can be difficult to choose the right one for your business. But if you pay attention to the following points, you can easily find the best service provider to work with.

1. Service Offering

Service and features offered by payroll providers differ from one another. Some offer select services like data entry or payroll tax returns, while others have comprehensive, full-service payroll management. Before partnering with payroll outsourcing companies, you must know what specific types of payroll solutions you need help with and if the company deals in that.

2. Customisation and Flexibility

How many times have you wished payroll outsourcing companies offered customised plans instead of readymade packages? As every business' needs are unique, so should be payroll services. Don't hesitate to ask the service provider if they're flexible enough to personalise services that give the best value for money.

3. Compliance

We don’t need to tell you that the Australian payroll system is indeed complex. Providers in charge of payroll processing are required to research and know about the latest updates. They must conduct payroll edits, check the accuracy and ensure full compliance. So check before outsourcing payroll to a company if they’re fully compliant with the law.

4. Data Privacy

When you handover the payroll management and processing to a third-party company, you’re sharing confidential information. To avoid compliance and risks of data breaches, you need to check what preventive measurements the provider takes. Seek complete information on how they store or systematically manage client data, records and decide whether you can entrust them with the job.

5. Customer Experience

A payroll outsourcing company that cares for its brand reputation takes customer experience seriously. Make sure to research their customer satisfaction rate. Check reviews, ask locally to find out what the past and present customers have to say about that.

A good payroll outsourcing company always maintains transparency, educates customers about the process, clearly explains charges and is ready to solve queries with care.

There’s a lot to consider before hiring external payroll providers. So it’s best to take time and explore companies or services that give you the best value for money. And when in doubt, contact Talo Financial to book a free call and talk to one of our payroll experts.

Wishing you great success with payroll outsourcing!

The Talo Financial Team

Registered BAS Agents - Tax Practitioners Board (TASA2009)

Liability limited by a scheme approved under Professional Standards Legislation.